Buy Verified Adyen Account

Original price was: $250.00.$199.00Current price is: $199.00.

ACCOUNT & VERIFICATION DETAILS:-

1. Photo ID verified

2. Email verified

DELIVERY MATERIALS:-

1. Login information

2. Photo ID

How does verification work?

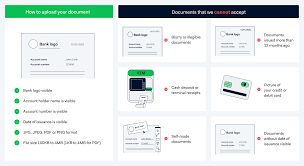

We usually verify your identity with some photo ID, proof of address, and/or a picture of you holding your ID.

Description

What is an Adyen Bank account?

Adyen became primarily based in 2006 through the way of a set of entrepreneurs, which includes Pieter van der Does and Arnout Schuijff. The existing bill era consisted of a patchwork of systems constructed on preceding infrastructure.

To assist corporations to grow, the co-founders set out to construct a platform able to assemble the rapidly evolving needs of recent times’ hastily growing worldwide corporations.

Adyen’s founding group referred to as the commercial corporation Adyen – Surinamese for “Start once more” – and centered on building a present-day infrastructure immediately related to card networks and nearby fee techniques the world over, bearing in thoughts unified alternate and providing consumer information insights to traders.

The Adyen platform enables merchants to just accept bills on a single device, allowing income to boom online, on mobile devices, and at the aspect of the sale.

Buy Verified Adyen Account

ACCOUNT & VERIFICATION DETAILS:-

1. Photo ID established

2. Email proven

DELIVERY MATERIALS:-

1. Login statistics

2. Photo ID

Local price techniques

When evaluating which fee techniques to assist, it’s important to not neglect your industrial employer model. If you’re a subscription commercial enterprise, for instance, some payment strategies are simply right for you as they don’t help with recurring payments. So ensure you understand the functionalities and regulations of each approach to your useful resource.

One settlement and one integration with Adyen provide you with entry to all key local fee techniques around the world, optimized for cell and ready text of the fielded. No want to install a community entity in each new market; going stay is as smooth as flipping a transfer.

You may even serve up a centered list of rate techniques based totally on your customers’ location, tool, and basket charge. So every patron most effectively sees the charge methods applicable to them.

Manage change with Adyen RevenueProtect

Get smart fraud defense constructed without delay into your payments answer with Adyen RevenueProtect.

RevenueProtect produces an international, real-time “graph” that spans verticals and geographies, permitting us to look at developments before every other company.

You can then without problem build smart policies tailored to your agency to identify fraudsters. And, to keep your commercial enterprise up to date- the Risk Engine uses tool Mastering to study and optimize hazard checks in actual time.

We’ll also help you find out the proper balance with 3-d Secure, and make sure you’re three-D Secure 2. Zero equipped. As a result, your fraud may be down and your income will be up.

Card authorization fees

25% of declined transactions lack valid motives.

Of direction, thcoursere accurate reasons to mention no to a transaction, like insufficient finances or suspected fraud. But frequently the cardboard is declined due to the fact there has been a temporary outage someplace inside the network, or the issuing financial institution’s interpretation of the price request becomes particular to the acquirer.

So what are you able to do approximately it?

The key lies in expertise as to why the card was declined in the first place. If you have these statistics, you’ll understand if the decline is valid and if now not, be capable of taking motion.

This is where the acquirer comes in.

The acquirer is commonly every other 0.33-birthday celebration provider within the charging gadget. But, in Adyen’s case, acquiring is built into our platform and we skip the records from the issuing bank without delay to our customers. So you could see which card bills were unsuccessful and why.

Reviews

There are no reviews yet.